Judge blocks GRA from seizing Mohameds’ luxury vehicles until ruling on tax evasion case

12 April 2025

12 April 2025

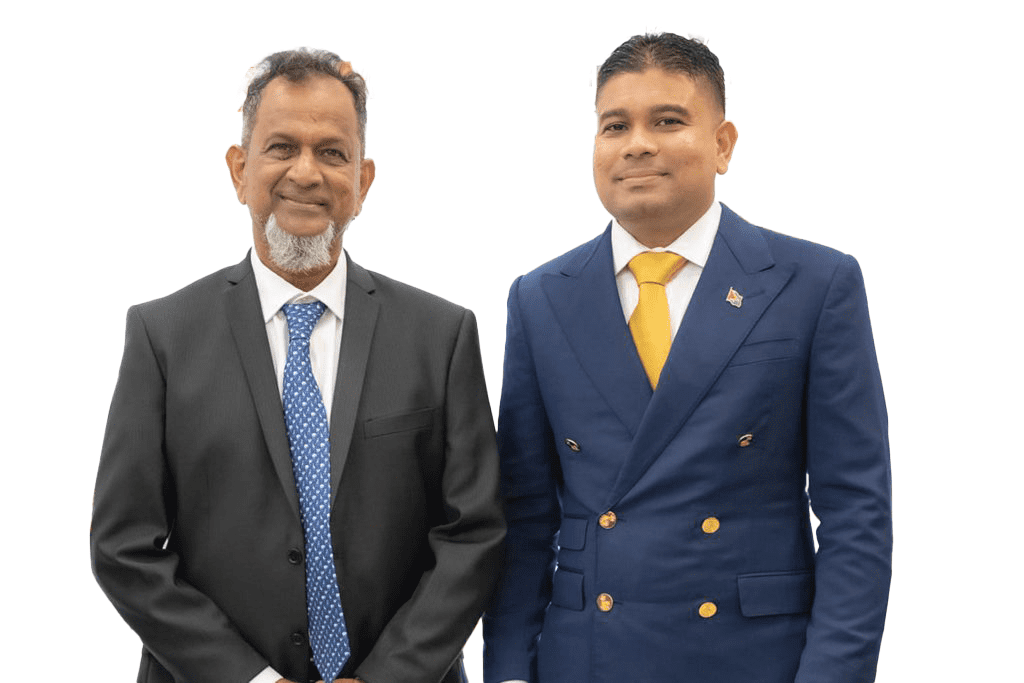

The High Court has issued an interim interlocutory injunction barring the Guyana Revenue Authority (GRA) from seizing several high-end luxury vehicles owned by prominent businessmen Azruddin Mohamed and his father Nazar “Shell” Mohamed, pending a full judicial review of the agency’s $1.2 billion tax evasion claim.

On Friday, Attorney-at-Law Siand Dhurjon, representing the Mohamed family, confirmed that Justice Gino Persaud extended an initial restraining order and granted further legal protection for the Mohamed’s vehicles—including a Ferrari 488, Lamborghini Roadster and two Toyota Land Cruisers, until a substantive hearing on May 15, 2025.

“The injunctions will last until the hearing and determination of the substantive matter. The substantive matter is what we have filed to quash the assessments and to prohibit any seizure or other enforcement action,” Dhurjon said.

The court’s ruling temporarily halts the GRA’s efforts to seize the vehicles, which the agency alleges were imported under false declarations and breaches of the re-migrant scheme—a programme designed to grant tax exemptions to eligible returning residents.

However, in a late press release regarding Friday’s ruling, the GRA stated that it will lodge an Appeal against the ruling, since the preservation of assets is not assured, and no bond has been lodged as is usual in these circumstances.

The release also noted that the extension of the Restraining Order has been issued pending a full trial, intended to maintain the status quo, and should not be interpreted as a final court decision.

The Authority reiterated that it has in its possession irrefutable evidence of the said breaches, and the understatement of values of the other vehicles, and will vigorously defend the said matters presently before the Court.

The legal action follows a tense April 5 stand-off at the Mohamed family’s Houston, Greater Georgetown residence, where GRA officers, accompanied by police ranks, attempted to seize the vehicles after months of failed negotiations and repeated notices. They were met by a hostile mob that blocked the entrance with other vehicles, forcing officers to retreat.

According to GRA, efforts to resolve the matter amicably had included three letters and direct email outreach, all of which went unanswered. The agency maintains it has “irrefutable evidence” of tax breaches and is pursuing the matter “without fear or favour.”

The vehicles at the centre of the controversy carry staggering unpaid tax liabilities, including $479.7 million for a 2020 Ferrari; $371.7 million for a 2020 Lamborghini Roadster; $320 million for a 2023 Rolls-Royce; $61.4 million for a 2023 Range Rover, and $24.6 million each for two Toyota Land Cruisers, pushing the total close to $1.2 billion.

Related News

“I believe in his vision” – former PNC Executive, Thandi McAllister, on supporting P...

Surinamese authorities rescue Guyanese fishermen after ordeal at sea

SOCU disrupts another major gold smuggling operation; over $60M in cash & gold seized