Increased benefits for citizens as legislations updated to introduce 2026 Budget measures

14 February 2026

14 February 2026

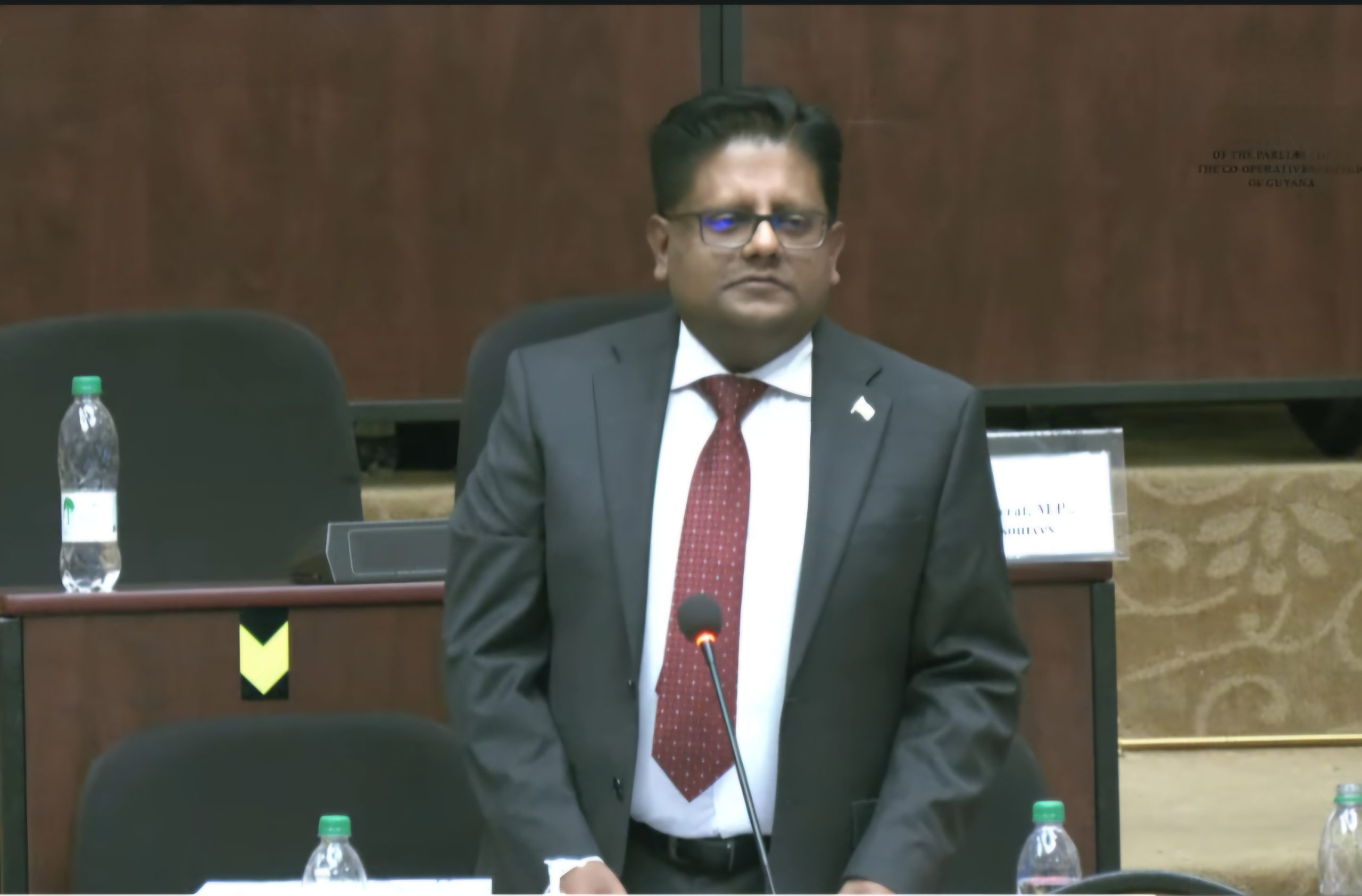

With the conclusion of debates in the National assembly, Senior Minister in the Office of the President with Responsibility for Finance Dr. Ashni Singh has successfully piloted the Fiscal Enactments (Amendment) Bill through the National Assembly to give effect to fiscal measures announced in Budget 2026. It has paved the way for a number of increased benefits to citizens.

The Fiscal Enactments (Amendment) Bill 2026, successfully piloted by the Senior Minister, allows for an amendment to the Income Tax Act, the Corporation Tax Act, the Value-Added Tax (VAT) Act, the Property Tax Act and the Customs Act. Once approved by the National Assembly and assented to by His Excellency the President, the amendments to the Income Tax Act and the Corporation Tax Act should come into operation with respect to and from the year of income commencing on January 1, 2026, while the amendments to the VAT and Customs Acts shall come into operation on February 16, 2026. Meanwhile, the amendments to the Property Tax Act shall come into operation with respect to and from the year of income commencing January 1, 2025.

These amendments will increase disposable income, reduce the cost of living, promote local production, stimulate investment in priority sectors, and provide targeted tax and duty relief to individuals and businesses. They give effect to Government’s fiscal policy measures for 2026, aimed at enhancing economic activity, supporting households, encouraging local production and reducing the overall cost of living.

Some of the measures announced in Budget 2026 by the Senior Minister that the Bill gives effect to are as follows:

1. Agriculture and agro-processing – With the aim of promoting productive activity and economic diversification, Government will this year remove the corporate taxes on agriculture and agro-processing businesses. This is also expected to increase retained earnings and enable greater investments to boost production and productivity.

2. Revise Export Allowance – Government will expand the list of products eligible for export allowance to include timber value added products This is aimed at enhancing competitiveness of qualifying exporters and lower their effective costs by reducing their tax payable, thereby allowing them to price their goods more competitively in international markets.

3. Removal of VAT on locally made furniture – Government will remove VAT on locally made furniture including doors, moulding, and beds, to increase competitiveness of the forestry sector, lower cost of construction, and support local manufacturers.

4. Removal of VAT on locally produced jewellery – Government will extend its support to the local jewellery subsector by removing VAT levied on locally manufactured jewellery.

5. Removal of Duty and VAT on security equipment – Government will remove duty and VAT on security equipment including security cameras and alarm systems, in alignment with its agenda of building safer communities and augmenting national efforts to combat crimes

6. Reduce the cost of vehicle ownership and hinterland transport – Government will introduce a flat tax of:

a. $2 million on double-cab pick-ups less than 2,000 cc, irrespective of age

b. $3 million on double-cab pick-ups between 2,000 cc and 2500 cc irrespective of age

7. Removal of VAT on vehicles below 1500 cc – Government will remove VAT on new vehicles below 1500 cc (new refers to vehicles less than four years old), to reduce the cost of importing such a vehicle.

8. Government will remove VAT on hybrid motor vehicles below 2000 cc – This measure is a further reflection of Government’s commitment towards low-carbon development and intended to support the gradual shift towards more environmentally friendly transportation alternatives.

9. All Terrain Vehicles – Government will remove all import duties and taxes on ATVs for all categories.

10. Outboard Engines – Government will be eliminating all taxes and duties for outboard engines up to 150 horsepower, in efforts to reduce the cost of transportation within hinterland and riverain communities.

11. Support for Elderly and Child Care Provision – Government will:

a. Remove the corporate taxes on companies that provide childcare and elderly services.

b. Provide $1.5 billion to support co-investment in child and elderly care facilities on the condition that companies benefiting from the co-investment support agree on a specified rate for these services.

12. Net Property Tax on Individuals – Government will remove the net property tax on individuals, which will increase the disposable income of these persons by over $1.4 billion. This measure is applicable from year of assessment 2026.

13. Income Tax Threshold – an increase in the threshold from $130,000 to $140,000 monthly, with effect from year of income 2026. This will result in the removal of 5,000 persons from the tax net whilst adding over $2 billion in disposable income to workers.

In addition to the above measures, the 2026 Budget provides for another measure in support of the tourism industry in Guyana through the removal of the 14 days residency requirement for destination weddings. Piloted in the National Assembly by Minister of Home Affairs, the Honourable Oneidge Walrond, the measure is expected to expand tourism-related economic activity to the benefit of the hospitality industry.

These and other Budget 2026 measures have earned the endorsement of a wide cross section of private sector stakeholders across the country. The Private Sector Commission noted that “From a business and productive activity standpoint, the measures announced will significantly enhance the operating landscape for the private sector. Targeted incentives through Special Development Zones, the removal of corporate tax on agriculture and agro-processing, revisions to the export allowance framework, and the removal of VAT on locally made furniture and jewellery all serve to boost local production, value-added activities, and export competitiveness.” The Georgetown Chamber of Commerce and Industry noted that they anticipated “a transformational effect on the playing field for Micro, Small, and Medium-sized Enterprises in particular” with the provision of US$100 million in Budget 2026 for establishment of the Guyana Development Bank. The Guyana Manufacturing and Services Association “welcomed the inclusion of several policy measures including: the removal of VAT on locally manufactured furniture, including doors, moldings, and beds; the revision of the export allowance to include value-added timber products; the removal of VAT on locally manufactured jewellery; the establishment of Special Development Bank and Economic Zones to support export-oriented manufacturing”.

At the same time, the Federation of Independent Trade Unions of Guyana lauded the “strong emphasis placed on direct cash transfers and income-support measures that will tangibly improve the daily lives of workers, pensioners, and vulnerable households. Of particular note is the $100,000 cash grant to all Guyanese aged 18 and above, a measure that provides immediate, broad-based financial relief.” The Tourism and Hospitality Association of Guyana expressed particular approval of the numerous policy and fiscal measures that will deliver immediate and tangible benefits for tourism operators, including the removal of all duties and taxes on All-Terrain Vehicles (ATVs) and the removal of duties and taxes on outboard engines up to 150 horsepower, noting that the measure will reduce operating costs for river transport providers, tour operators, and eco-lodges.

As highlighted by His Excellency the President on December 17, 2025, for this Government “people come first, always”.

Subscribe to get the latest posts sent to your email.

Related News

CWI, apparel partner Macron unveil official playing kits for ICC Men’s T20 World Cup 2026

Cocaine found in rice, chemical shipments from Guyana; likely contaminated during transshi...

Fire guts Albion house