Investors are currently permitted to repatriate 100 per cent of their capital and profits made in Guyana without any hindrance – a practice that the Guyana Government could review in the future.

This is according to Chief Investment Officer and Head of the Guyana Office for Investment, Dr Peter Ramsaroop. He was at the time speaking at the Guyana Energy Conference and Supply Chain Expo on Thursday, highlighting opportunities for foreign investors.

“One of the biggest benefits that is there today [for foreign investors], and I will ask the AG (Attorney General) over time that we change that, is that you can repatriate all your capital and your profits out of Guyana without any penalty,” Ramsaroop stated.

In the same breath, the Investment Chief urges foreign investors to bring their own capital when investing in Guyana. This, he explained, will leave space for local companies to access financing – something that is already a challenge in the country.

“Our banks are there to help our local people. If you’re coming to Guyana to invest, bring your money. A lot of people are coming in and going to the local banks. Our banks are open to lending, but they want to be a partner, and so, with repatriation of capital and all your foreign exchange, that becomes an issue over time,” the Go-Invest Head stated.

Access to and availability of foreign currency, particularly United States dollars, continues to be a sore point for the local private sector. Many businesses have been complaining of the lack of foreign currency, which hinders their operations.

However, the Bank of Guyana continues to maintain that there is sufficient foreign currency in the country. In fact, just last year, President Dr Irfaan Ali had introduced a new series of measures aimed at tightening oversight, reducing capital flight, and ensuring transparency in foreign exchange transactions.

This intervention to stabilise the local financial sector saw the implementation of a new foreign exchange monitoring mechanism. It was found that transactions by large-scale foreign currency users are not always reflected in Guyana’s formal financial system.

“We’re not going to restrict Guyanese from purchasing foreign currency… We’re going to try to close the loopholes on some of those who have been abusing the system… For example, the Chinese supermarket that you are seeing, where most of these supermarkets don’t have a bank account…and they’re importing a lot of goods to sell in their supermarkets. How are they getting the foreign currency? So, closing these loopholes would allow us to collect more taxes from these foreign entities, mainly, who are operating here, or if they are using our foreign currency on credit cards to meet demand in another country,” Vice President Dr Bharrat Jagdeo had indicated.

In fact, the Chinese Embassy in Georgetown subsequently issued a public statement calling on Chinese-owned and Chinese-operated entities in Guyana to engage in lawful business operations, including opening bank accounts and applying for relevant licences to conduct business here.

But the Vice President had subsequently pointed out that there are still some persons who try to beat the system despite safeguards put in place.

“We have a number of people who still think they can beat the system, especially people [from foreign countries] – not the Guyanese so much. You know the groups that we’re looking at [that] create leakages to pay for goods going to Trinidad. We still have that as a big pressing issue,” Jagdeo had noted.

Nevertheless, Ramsaroop assured delegates at the Energy Conference on Thursday that the Guyana Government continues to do everything possible to ensure a friendly business environment for investors, including changing the local legislation to ensure investments are protected. In fact, he noted that Guyana is among the few countries where investments, including foreign investments, are protected.

This point was emphasised by Minister of Public Utilities and Aviation Deodat Indar during his presentation at the Energy Conference on Thursday, where he stressed the sanctity of contracts here and assured the business community that their investments are fully protected and secure.

“When we in Guyana enter into a contract, we make sure that that contract stands the test of inviolability, and the dictionary defines that as not to be broken or never to be broken, infringed or dishonoured,” Indar informed delegates.

“So, in Guyana when we sign a contract, regardless of how bad it is or how good it is, we stick by it, and that stability is what brings people to Guyana,” he affirmed.

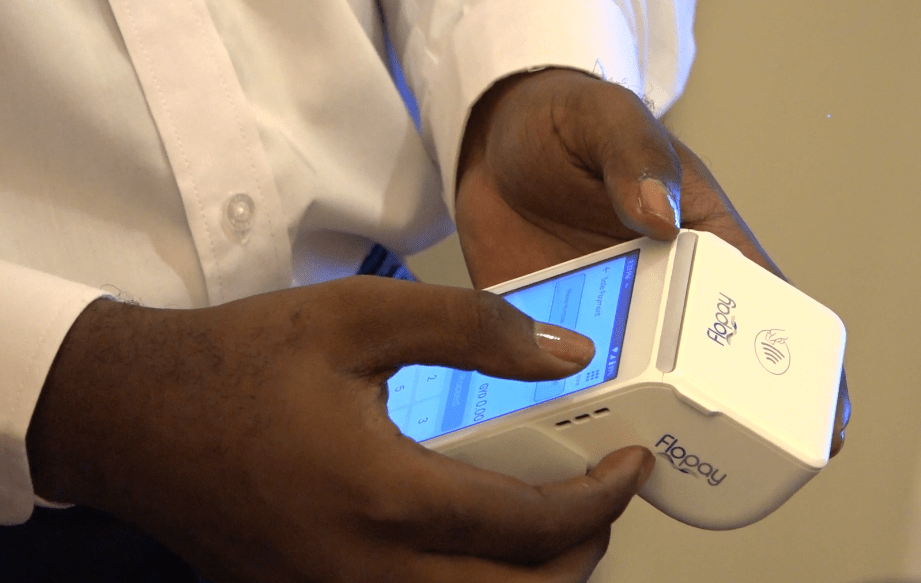

Pic saved as: Peter Ramsaroop

Caption: Chief Investment Officer, Dr Peter Ramsaroop

Subscribe to get the latest posts sent to your email.