GCCI hails VAT removal on back-up generators, other measures in Budget 2025

23 January 2025

23 January 2025

See full statement:

The Georgetown Chamber of Commerce & Industry on Budget 2025

The Georgetown Chamber of Commerce and Industry (GCCI) extends congratulations to the Government of Guyana on the presentation of the $1.382 trillion 2025 National Budget under the theme ‘A Secure, Prosperous, and Sustainable Guyana’—which was notably an increase of 20.6 per cent from the 2024 National Budget, with no new taxes.

As Guyana’s development continues on an upward trajectory, the Chamber is pleased with the projected GDP growth of 10.6 per cent for 2025, coupled with the anticipated 13.8 per cent growth in the non-oil economy this year. With these projections, Guyana is expected to remain the world’s third fastest-growing economy. This comes on the heels of the country’s noteworthy economic performance in 2024—43.6 per cent overall and an increase of 13.1 per cent in the non-oil economy.

Guyana’s development and outstanding economic performance requires prudent economic management and measures, and the Chamber has taken note of several interventions that cater to increasing sectoral performances sustainably, while investing in socio-economic development.

The Chamber wishes to firstly applaud the Government for increasing the income tax threshold to $130,000, while decreasing the PAYE rate to 25 per cent, thereby increasing employees’ disposable income. These measures, in conjunction with several other cash injections through one-off cash grants, annual cash grants, and old age pensions and public assistance increases, as well as measures to alleviate the cost-of-living amount to a keen focus on improving citizens’ welfare.

The GCCI also commends the increased investment in the agriculture, extractives, manufacturing, construction, and services sectors, particularly given the projected sectoral growth. Additionally, the Chamber has noted the strong focus on infrastructural development and the energy sector. It is crucial that focus be placed on aligning

the country’s infrastructure with the increased investment interests—especially as it relates to energy and transportation infrastructure.

Among the numerous projects announced, the Chamber wishes to highlight the focus on small business development with the injection of $3 billion for the establishment of industrial estates in Regions 2,3,4 and 10.

This, in addition to the proposed removal of import VAT machinery used in the agriculture sector, the removal of VAT on automated poultry pens and veterinary supplies, and back-up generators, as well as measures to reduce freight costs are welcomed interventions.

Over the years, the GCCI has continued to highlight challenges with the labour shortage, as such, the move to invest heavily in the education sector—including the funding of the University of Guyana and other technical institutes across the country, thereby removing tuition—must be commended as a step in the right direction. This will further enhance the country’s workforce and ability to meet the needs of all sectors—particularly the oil and

gas industry.

The GCCI remains resolute in its role as an advocate for economic development and increased standard of living in Guyana. The Chamber supports the Government of Guyana in these initiatives and welcomes Budget 2025 as a vehicle for continued growth and development.

Related News

Serious crimes down by 42.6% in Region 7 - Commander

Paediatric and Maternity Hospital at Ogle, 6 regional hospitals for completion this year

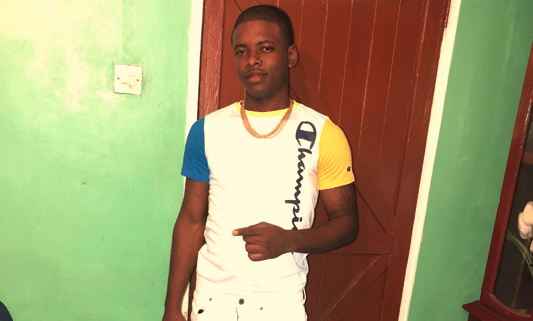

State will pay $24M compensation for unlawful killing of Quindon Bacchus – Jagdeo