Minister of Tourism, Industry and Commerce, Susan Rodrigues, has disclosed that the operations of Guyana Development Bank will be regulated by law to safeguard against discrimination and political interference.

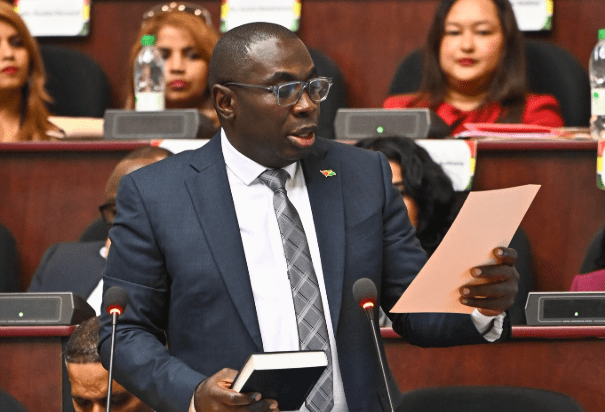

She was responding to questions as Committee of Supply examined allocations under the Ministry of Tourism, Industry and Commerce in the 2026 National Budget.

A major focus of the engagement was the proposed Development Bank, for which the government has allocated an initial US$100 million in this year’s budget.

“This budget caters for the initial US$100 million dollars… the pledge is US$200 million,” Rodrigues informed.

She explained that the bank forms part of the government’s manifesto promise to address long-standing complaints from small and medium-sized enterprises about access to financing.

The bank will offer collateral-free, interest-free loans of up to GY$3 million, with the possibility of an additional $7 million in financing from commercial institutions at preferential rates.

The institution will not only provide financing but will also include a training and proposal-development component to help entrepreneurs strengthen their business plans and improve sustainability.

Opposition Members of Parliament raised concerns about oversight and the potential for political interference in loan approvals. In response, Rodrigues said the bank would be established as a legal entity governed by legislation.

“It will be a legal entity… a draft legislation will govern the administration of this fund,” she said.

She further confirmed that the Attorney General’s Chambers is working on the legislative framework and that the bill will come before the National Assembly for debate.

“The legislation has been drafted. It will come to this House for debate and subsequent passage,” she stated.

Addressing concerns about discrimination, Rodrigues maintained that safeguards would be embedded in the institution’s structure and the government’s broader governance approach.

“This is a government that does not discriminate against anyone,” she said, adding that digitisation of public services is intended to reduce subjectivity and bias in State processes.

“We have been transitioning all of our services electronically… to address this issue of subjectivity and bias.”

Rodrigues also clarified that the existing Small Business Bureau (SBB) will continue to operate alongside the new development bank. Its loan guarantee programme and advisory services will remain available to small businesses.

Subscribe to get the latest posts sent to your email.

Related News

Miner found dead with chop wounds at Issano; 2 arrested

Tickets for Republic Bank CPL 2026 finals go on general sale on Feb 7

'Guard against misinformation' - McCoy urges as budget debates unfold