Central Bank injects US$35M to address foreign currency shortage on local market

27 March 2025

27 March 2025

The Bank of Guyana has once again stepped in to address the shortage of foreign currency on the local market, injecting US$35 million on Thursday. This was disclosed by Vice President Dr Bharrat Jagdeo during his weekly press conference.

“We only address mismatch between flow of currency and demand for currency, the timing to smooth out flows we intervene…like today, the Central Bank intervened and put US$35M into the banking system,” he noted.

This injection comes as businesspersons are complaining about the time taken to access foreign currency for international purchases.

The Vice President said while the Government has the capability of releasing foreign currency into the local market, it is important to look at legitimate demand.

He added that too much release can lead to appreciation of the currency which has negative impacts on the economy.

“If you put too much money in at once, you cause an appreciation of the currency and that could ultimately lead to the Dutch disease – it is bad for agriculture and bad for manufacturing,” Jagdeo explained.

The Central bank has intervened several times in the past to stem the shortage of foreign currency. This follows consistent monitoring of the banking sector.

At the end of 2024, President Dr. Irfaan Ali had noted that the availability of foreign currency in the local banking sector has been fluctuating throughout that year, as the demand for imported products continued to rise.

Dr. Ali disclosed that the importation of consumer goods which include food and motor cars grew by 106% from 2019 to 2024 while fuel, chemicals and other intermediate goods grew by 160%. Meanwhile, he said there has been a 317% increase in credit and debit card usages.

According to the Head of State, the sale of foreign currency to the commercial banks between 2019 and 2024 grew by 1744% to help support the growth and expansion to the economy.

Also in December 2024, President Ali had noted that a probe was ongoing into the possible exploitation of foreign currency availability in the local banking sector. “We have to see whether there are other markets that are buying through our system for their markets, and that is something that we are looking at,” he had said.

Related News

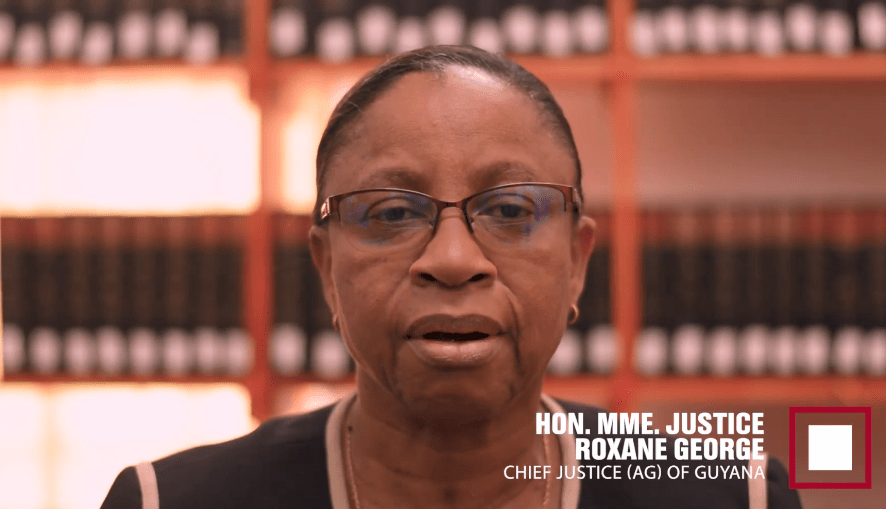

CJ to rule on 'residency of voters' case on March 28

Parents demand answers after 9-Y-O son dies less than 24 hours after falling ill

Guyana will not be intimidated, we will defend every square inch of our land - Pres. Ali t...